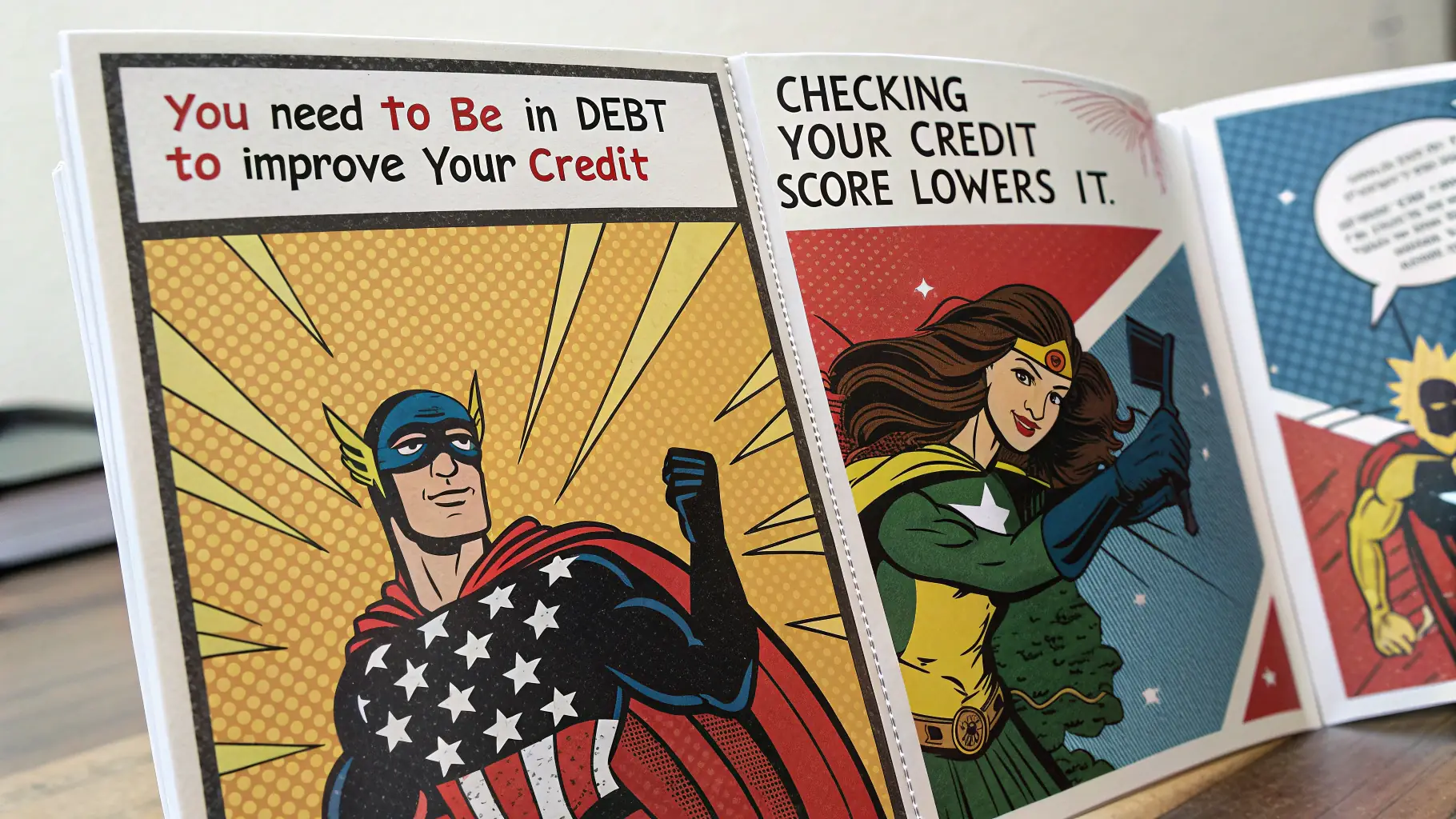

There are many misconceptions about credit improvement that can hinder individuals from taking the necessary steps to enhance their credit scores. One common myth is that checking your own credit score will lower it. In reality, checking your own credit is considered a soft inquiry and does not affect your score at all. Understanding these myths is crucial for anyone looking to improve their credit profile and make informed financial decisions.

Another prevalent myth is that closing old credit accounts will improve your credit score. In fact, closing old accounts can negatively impact your credit utilization ratio and shorten your credit history, both of which are important factors in determining your score. At Credit Max24, we aim to educate our clients about the realities of credit improvement, helping them navigate the complexities of credit scores and tradelines. By debunking these myths, we empower individuals to take control of their financial futures.

Finally, many believe that credit improvement is a quick fix that can be achieved overnight. The truth is that improving your credit score takes time and consistent effort. However, with the right strategies and support from experts like those at Credit Max24, you can see significant improvements in a relatively short period. Trust us to guide you through the process and help you achieve your credit goals while dispelling the myths that may be holding you back.